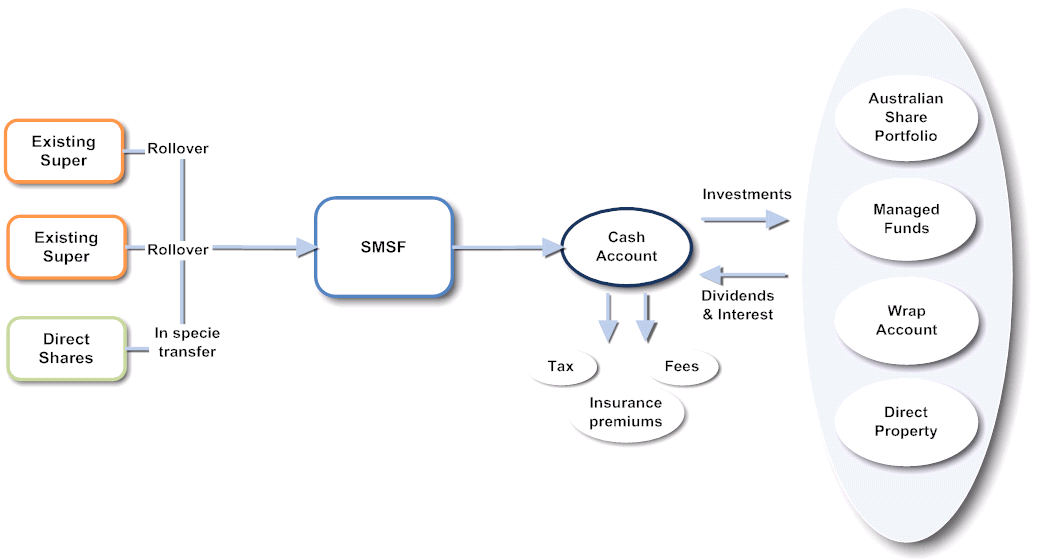

Self-managed superannuation funds (SMSFs) are listed on: Australian Government's 'Super Fund Lookup'. How can I transfer my superannuation to a new super fund? A request to transfer your superannuation benefits must be directed to your fund in writing. The fund is required to transfer your superannuation benefits within three business days.. SMSF - know your options; How we invest; Environmental, Social & Governance; What we invest in; FAQs; Climate Change;. This website is provided by AustralianSuper Pty Ltd ABN 94 006 457 987, AFSL 233788, Trustee of AustralianSuper ABN 65 714 394 898 Superannuation Fund Number (SFN): 2683 519 45, Superannuation Product Identification Number.

Australian Super Compliance Letter All You Need To Know

Australian Super SMSF SMSF Management SuperManage

Selfmanaged super funds (SMSF) Moneysmart.gov.au

Understanding The RSA Course in NSW Requirements and Regulations

SMSF Australia’s first ETF for SMSFs BGL Corporate Solutions Pty Ltd

SMSFs and Investment Strategies SMSF Administration + Advisory Axiom Super Solutions

SMSF Transfers Holborn Assets Australia

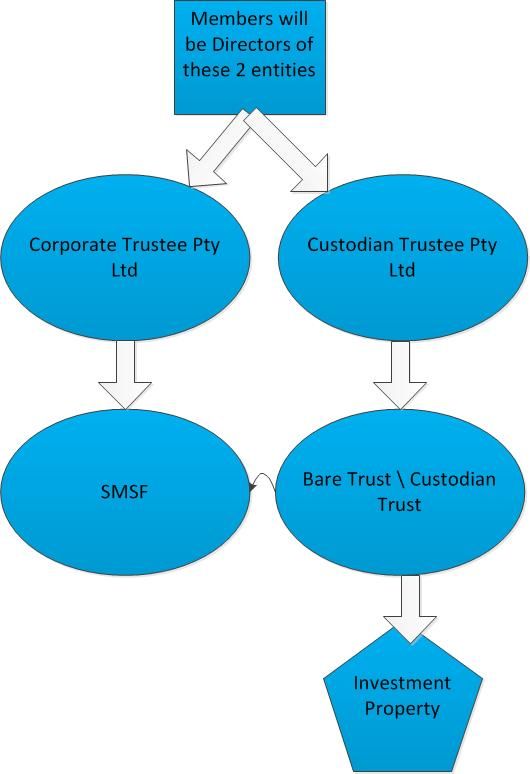

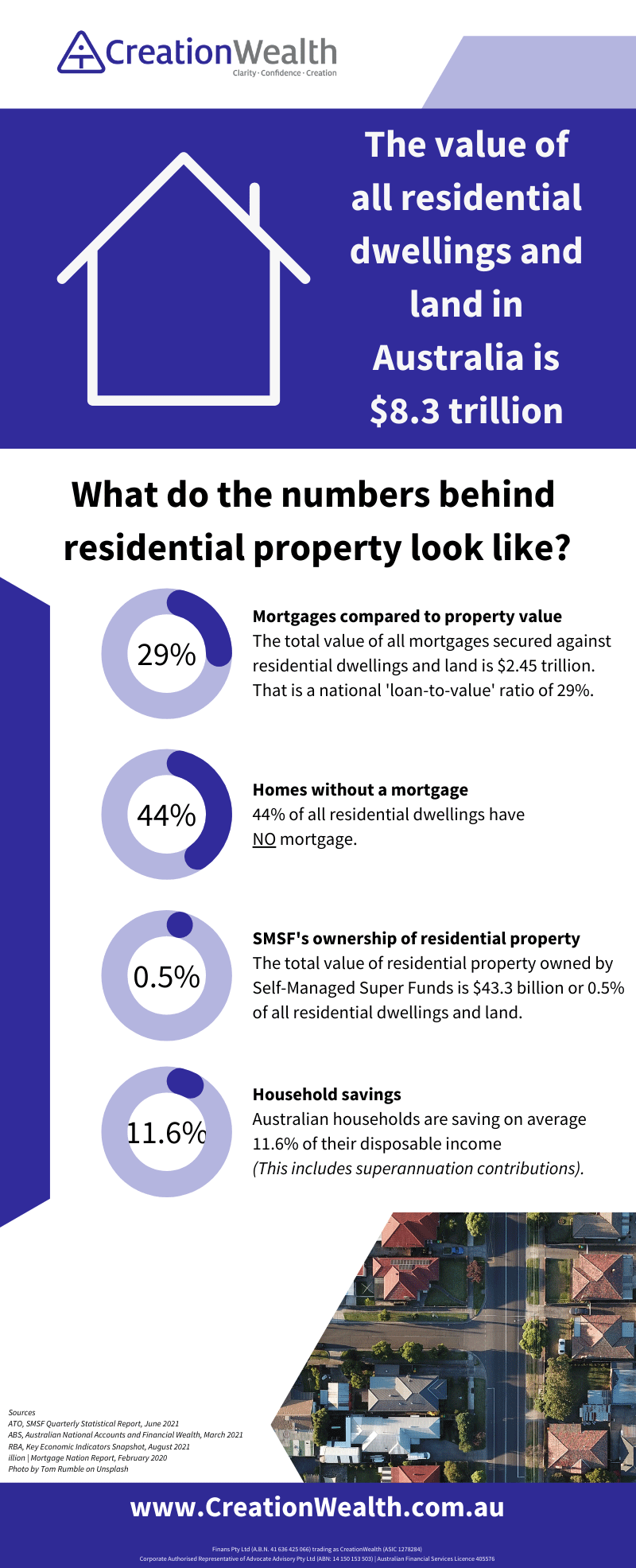

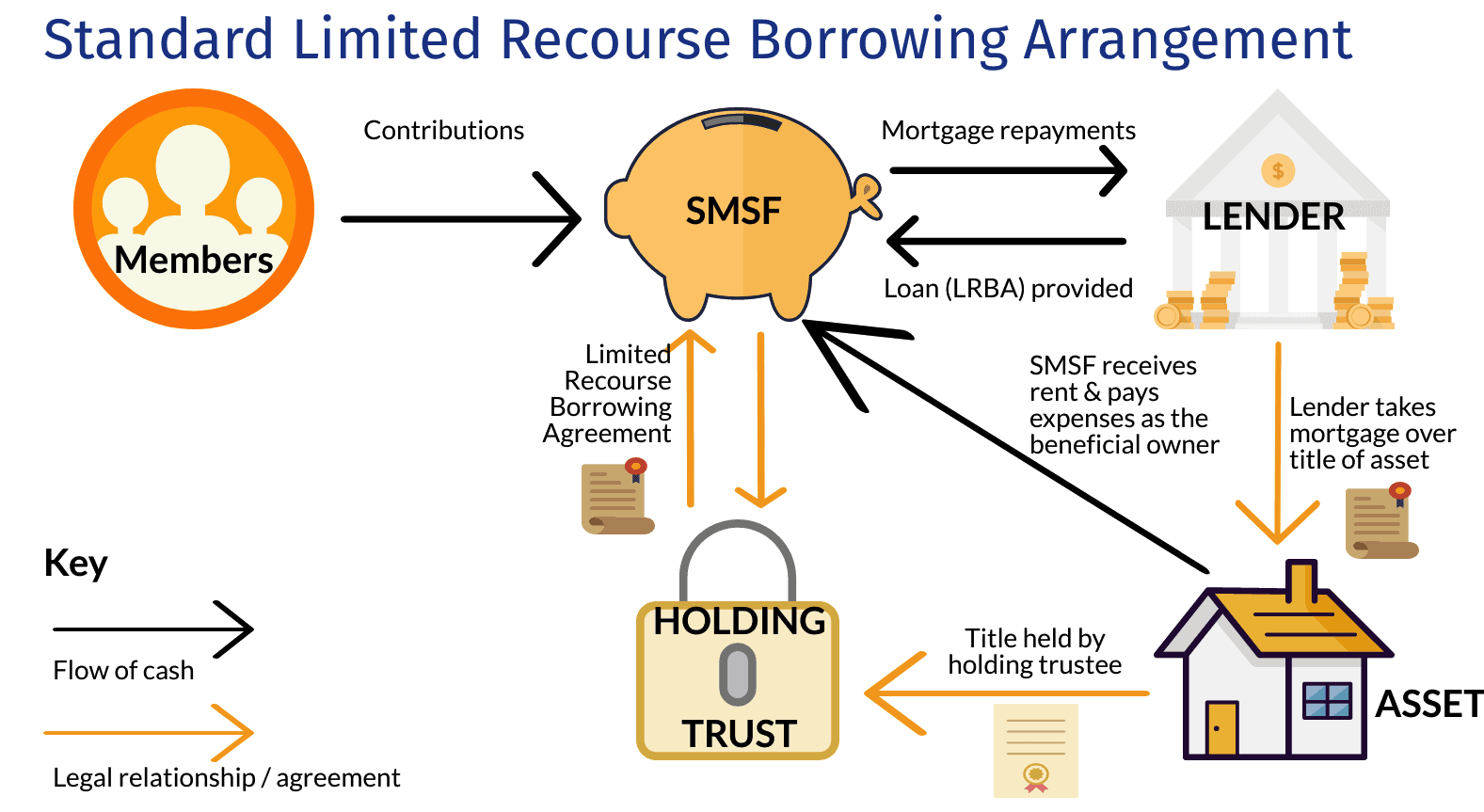

Self Managed Super Funds (SMSF) Property Investment Property In SMSF SMSF Warehouse

Based in Melbourne and providing SMSF services Australia wide Quick SMSF Accountants

Understanding the Benefits of SelfManaged Super Funds (SMSFs) in Australia AUZI Tax

How Does a Self Managed Super Fund Work? Self Managed Super Funds SMSF

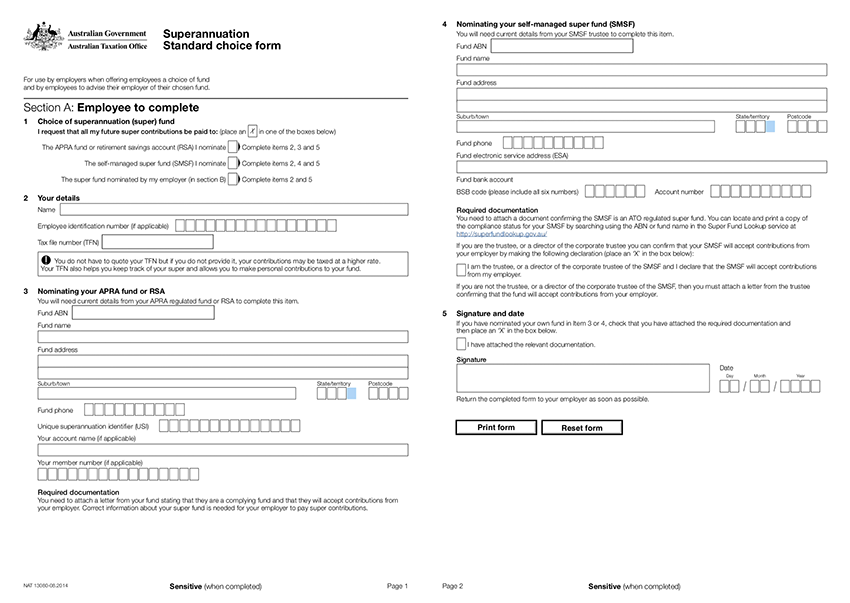

Superannuation Standard Choice Form pre2023 version

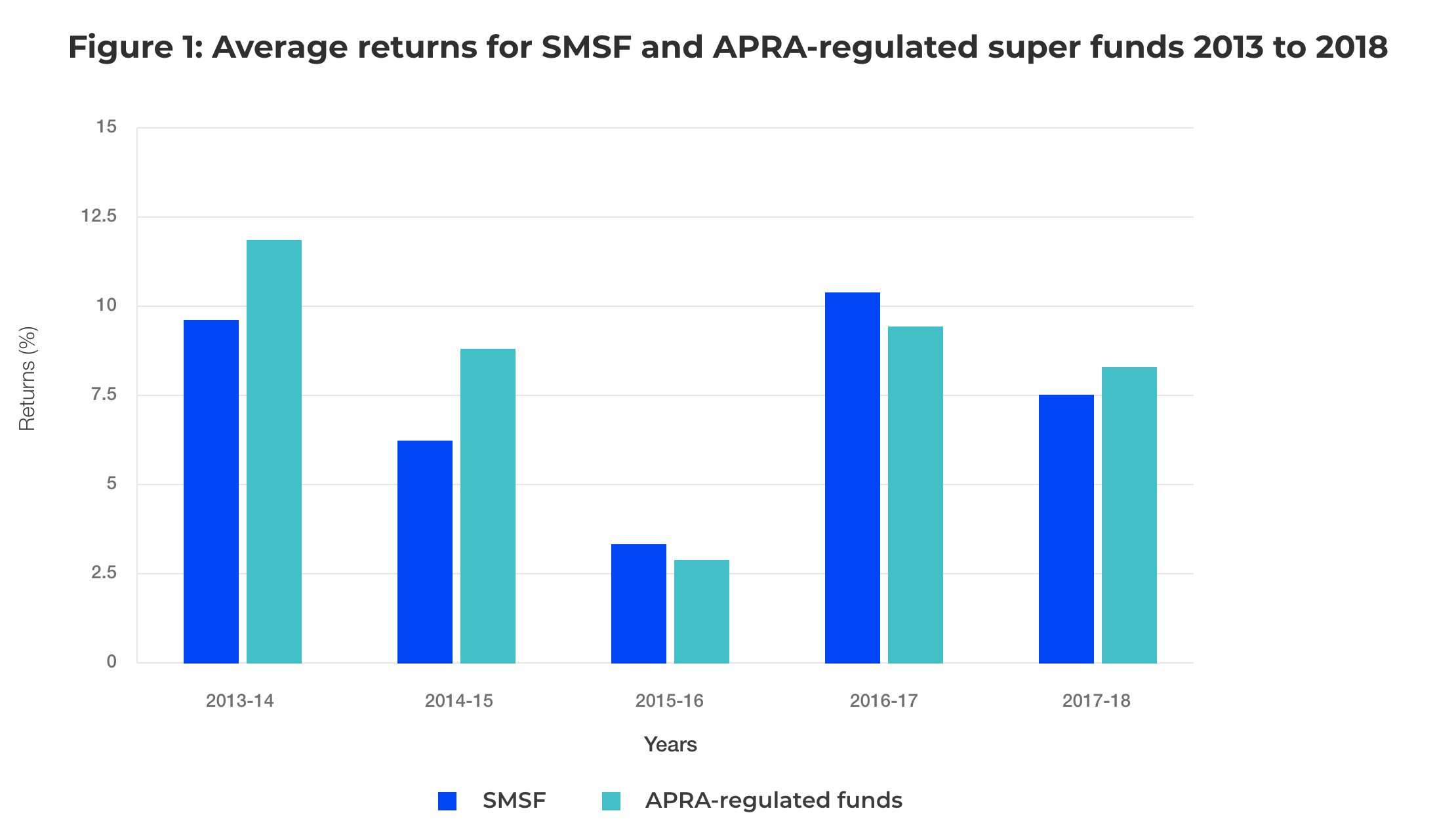

SMSF vs. industry super Is a SMSF right for me? Liston Newton

4 things to consider when setting up an SMSF to buy property

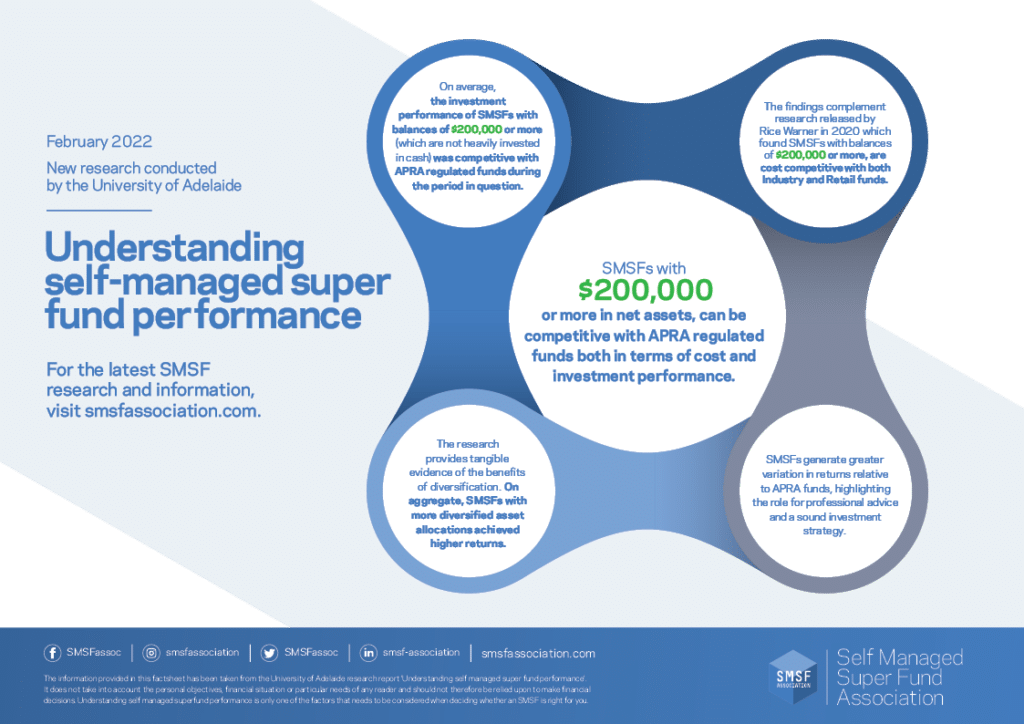

Fact Sheet Understanding selfmanaged super fund performance SMSF Connect

Is a SMSF the best performing Super Fund in Australia? YouTube

Buying property with super SMSF property investment FAQs

SMSF Australia Specialist SMSF Accountants Croozi

Module 1 Introduction to Super & SMSFs Accountants Daily Knowledge Centre

Blog Tactical Super Australian SMSF Audit Specialists

An SMSF is an Australian super fund if it meets all 3 of these residency conditions: The fund was established in Australia, or at least one of its assets is located in Australia. The fund was 'established in Australia' if the initial contribution to establish the fund was paid and accepted in Australia. The central management and control of the.. An SMSF is sometimes called a DIY super fund. Learn how an SMSF works, and how you can have more control of your super with Australian Retirement Trust.. Check your fund is an Australian Super fund and meets the residency rules.. (RSA). An RSA is a type of long-term savings account with a bank, building society, credit union, or other.