Introduction to ex gratia payment. An ex gratia payment is presented to an individual by an organization, government, or insurer for damages or claims. Still, it does not need the admittance of liability by the party initiating the payment. An ex gratia payment is viewed as voluntary because the party making the payment is not obligated to compensate the individual.. Last updated on October 6, 2023. "Ex gratia" is a Latin term which translates to "by favour". An ex gratia payment is a voluntary payment made to an individual even though the party making the payment is not obligated to do so. Such payments are generally regarded as a gesture of goodwill to maintain good relations.

Scheme for grant of Exgratia Payment Relief to Lenders & Borrowers

राजस्थान अनुग्रह भुगतान Ex Gratia Payment Status, List Check (1st/2nd किश्त )

Ex gratia payment What does it mean? Housing News

Settlement agreements and ex gratia payment, what is taxable

Ex Gratia Payments in Settlement Agreements

Ex Gratia Payment

Ex Gratia Payments The Genuine Gesture That Goes Beyond Obligation

Ex Gratia in Insurance Explained GetInsurance

ExGratia Payments by a Charity The Legal Lowdown

ExGratia Payment In Malaysia Understanding The Taxation Of Severance Payments In Challenging

Ex Gratia Payment

Ex Gratia Payment Letter Sample 8 Payment Request Letter Templates Pdf Free Premium Templates

Exgratia payment to kin of Covid victims under consultation Government

What Is Ex Gratia Payment? Askcorran

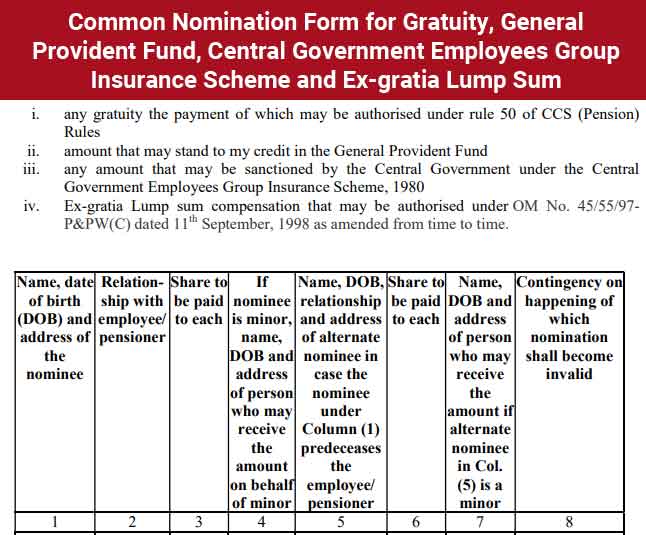

Ex gratia payment on death of employee Common Nomination Form for Gratuity, General Provident

Ex Gratia Letter To Employee A Guide To Ex Gratia Payments I Michael Law Group Prisco Cremonesi

ExGratia Payment Received on Voluntary Retirement Not Taxable as “Profit in Lieu of Salary

Ex Gratia Payment Finance Reference

Presentation on FROM SALARIES ppt download

ExGratia Payment to CPF Retirees who retired after 31121985 Appeal for removal of

Ex Gratia Payments are voluntary and not legally required, offering flexibility in compensation strategies. While often made as goodwill gestures, such payments can have significant tax implications for both parties. They differ from regular bonuses or compensation, as Ex Gratia Payments are not a matter of contractual right.. Call us: 02033973603. Email us:[email protected]. Redundancy payments and ex gratia payments to employees. In redundancysituations you can receive the following sums as an ex-gratia payment: Statutory redundancy pay; and. Any lump sum compensation payment paid, subject to the £30,000 tax-free limit. To be clear, the £30,000 limit.