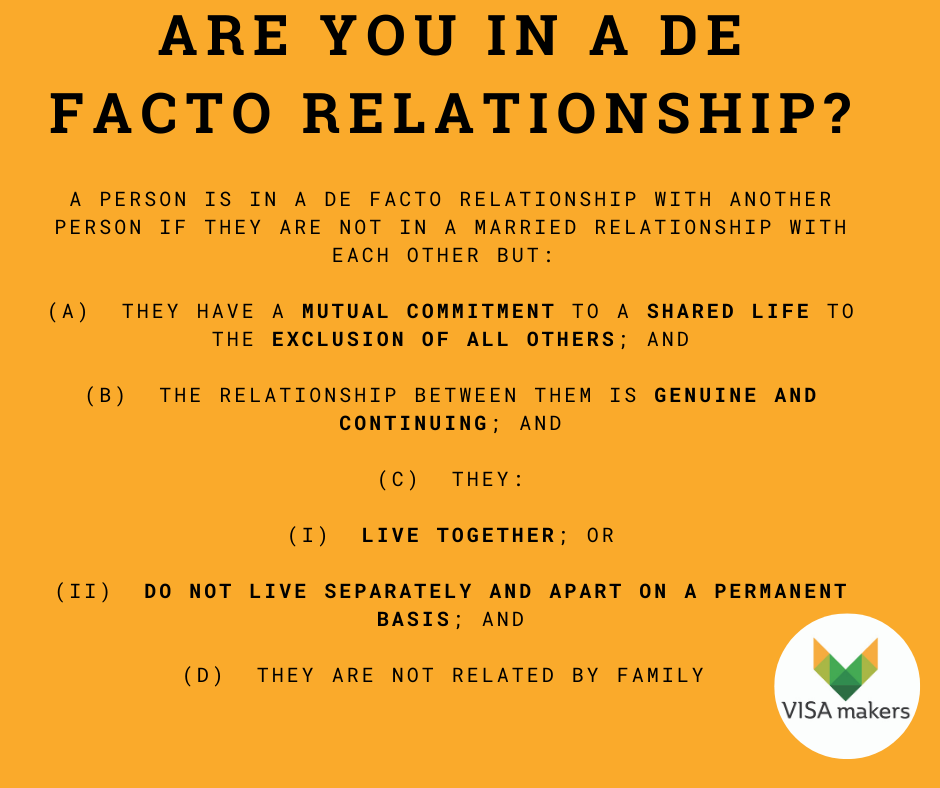

Australian law defines a de facto relationship as a couple living together on a genuine domestic basis. The Family Law Act 1975 recognises: Opposite sex or same-sex couples;. tax or superannuation benefits. For example, in the event of a partner's demise without a will, a relationship certificate ensures de facto relationship entitlements.. Book an appointment online today. Our H&R Block accountants are now working online. Book an appointment with an expert. If you're married, engaged or in a de facto relationship, you may need to include your partner in your tax return. Learn how the ATO uses this information.

Immigration To Australia News Visa Makers Migration Agent Perth Visa Makers

De Facto Relationship in Australian Law Fill Your Articles

A quick guide to taxes in Australia Australia Property Guides

PPT DeFacto Tax Australia All You Need to Know PowerPoint Presentation ID12638966

De Facto Tax Benefits Australia A 7Point Comprehensive Guide Melbourne Family Lawyers

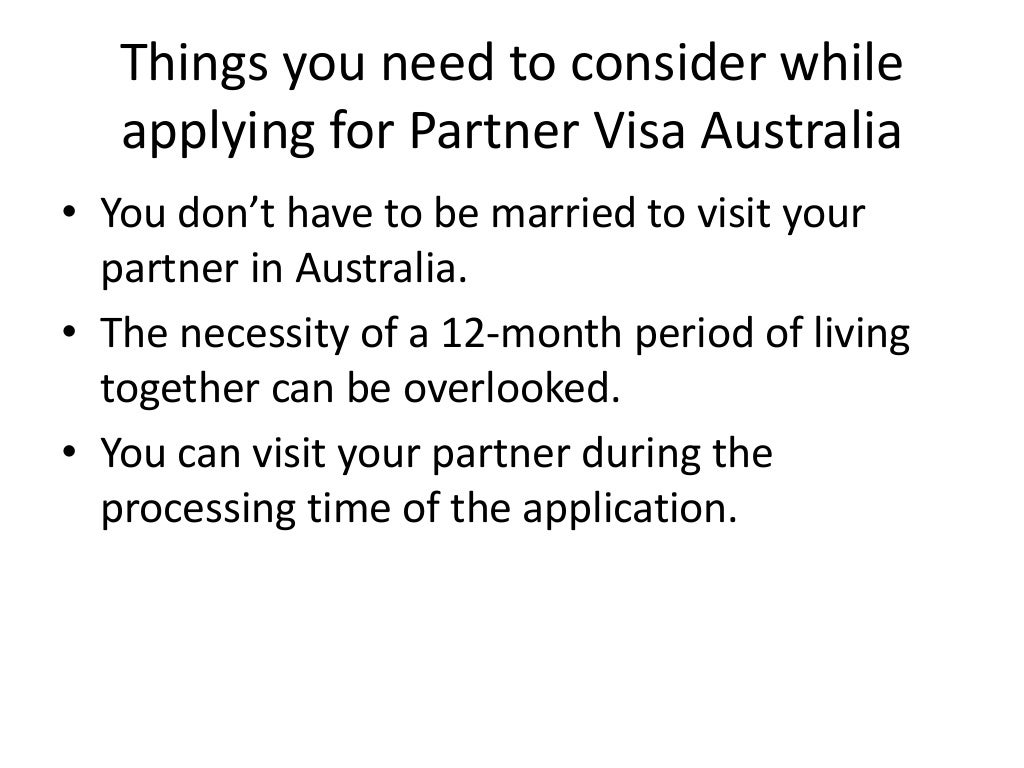

All about de facto relationship and its requirements for australian partner visa (1)

Australian business taxes Abdera Business Services

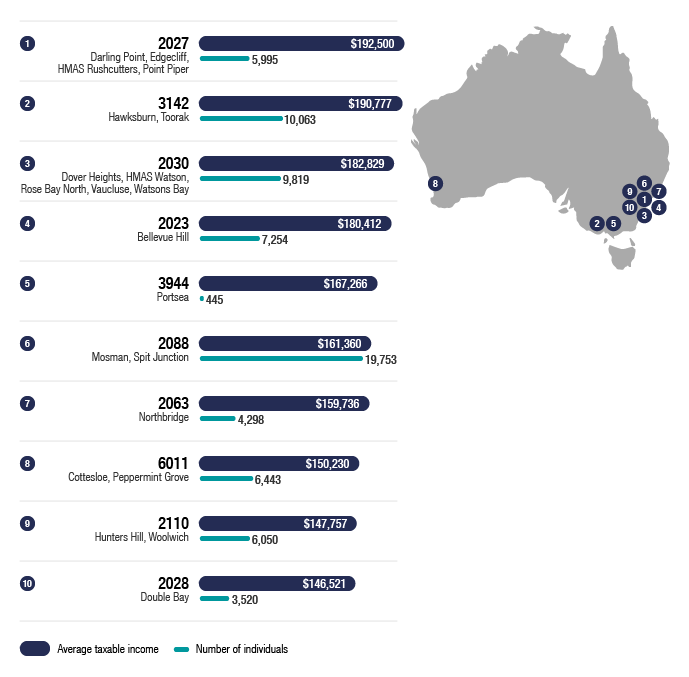

At a glance Treasury.gov.au

Here’s everything you need to know about Australian taxes This is Australia

Australian Taxation What Constitutes as for Residents and Non Residents

![How Does Australia's Tax Rate Compare To The Rest Of The World? [Infographic] How Does Australia's Tax Rate Compare To The Rest Of The World? [Infographic]](https://imgix.lifehacker.com.au/content/uploads/sites/4/2015/09/Money.jpg?ar=16:9&auto=format&fit=crop&q=80&w=1280&nr=20)

How Does Australia's Tax Rate Compare To The Rest Of The World? [Infographic]

How does tax work in australia Rask Education

Do I Have to Pay Tax on My Cryptocurrency Earnings in Australia? Savvy

The 10 Top Tax Benefits for Businesses

Tax stats reveal the state of the Australian community

DeFacto Tax Australia — All You Need to Know by Taxly ai Nov, 2023 Medium

How to Claim work related expenses make deductions in tax Australia YouTube

Tax return How to save 17 per cent on investment tax — Australia’s leading news site

Explained How does tax work in Australia (video)? YouTube

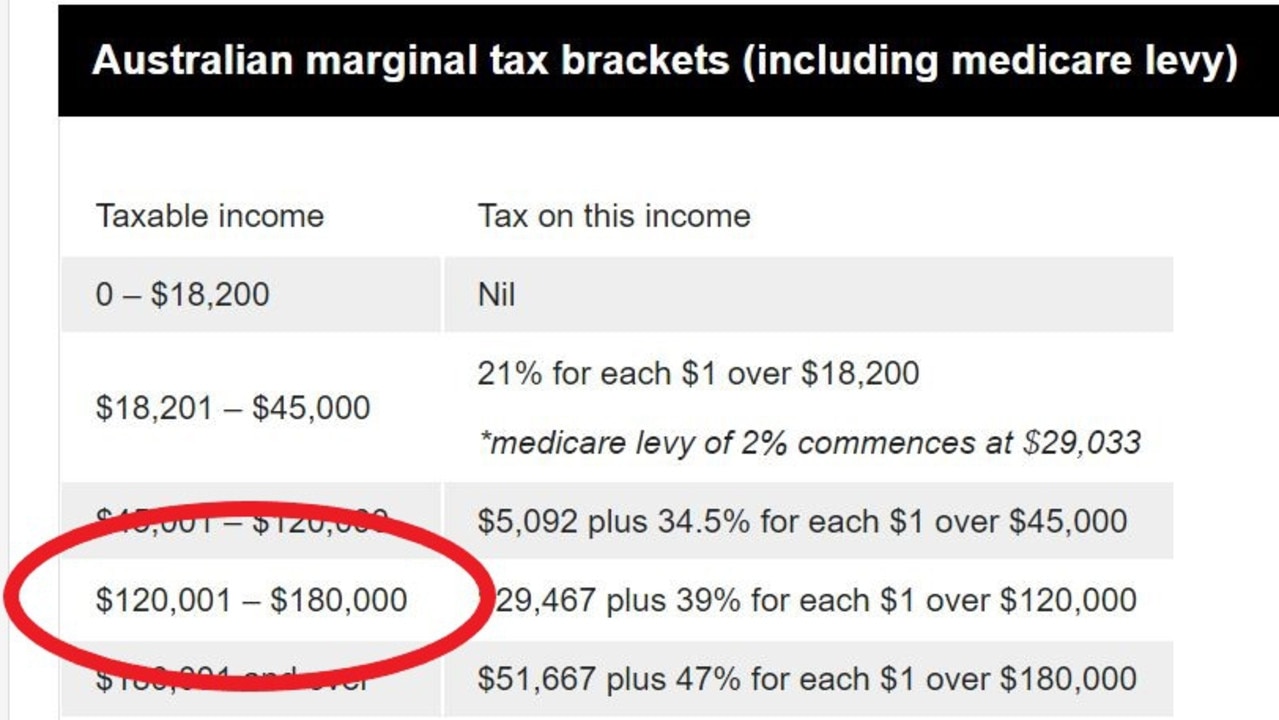

Tax In Australia What Are Tax Brackets And Rates?

For tax purposes a dependant does include a child of your de facto spouse. When you lodge your tax, you'll let us know you had a spouse and dependant for part of the year.. Government, Canberra. We acknowledge the Traditional Owners and Custodians of Country throughout Australia and their continuing connection to land, waters and community.. No such provision exists for de facto couples; they must file proceedings within two years. In many states, a new marriage nullifies an existing will, unless that will was quite specifically worded.