Bridge loan rates for Moore-Haven, Florida start at 2.00% in 1st posion and 6.68% for bridge loans in 2nd postion . Lendersa® lenders' list includes all the financial institutions and private hard money lenders who can arrange Bridge Loans on residential or commercial properties in Florida.. DELAFIELD, Wis., July 27, 2021 /PRNewswire-PRWeb/ -- Prescient Capital Management recently closed a short-term bridge loan on a RV Park based in Moore Haven, Florida. The strategic goal of the Borrower was to use the proceeds from the Prescient Capital loan to refinance out of a seller-financed loan. The loan request is for $1,930,000, and.

Bridge Loan Network Mortgage Professional

PPT Commercial Bridge Loans PowerPoint Presentation, free download

Bridge Loans For Investment Properties Lending Guidelines

BRIDGE LOANS HOW TO GET MORE OFFERS ACCEPTED YouTube

:max_bytes(150000):strip_icc()/TermDefinitions_Template_bridgeloancopy-d328395628e94431ac99ef25b3f970b4.jpg)

What Is a Bridge Loan and How Does It Work, With Example

What is a Bridge Loan? YouTube

Bridge loan meaning features how it works pros and cons Artofit

Bridge Loans Mason Mortgage

Bridge Loans What They Are, How They Work Garden State Home Loans NJ

Moore Haven Railroad Swing Bridge in Moore Haven, FL, United States

Bridge Loans Overview & Highlights YouTube

The Caloosahatchee Canal & Bridge Moore Haven, Florida Jimmy

Bridge Loans Part 2 Pricing of Loans Skylatus Property Capital

Bridge Loans 101 The A Z Guide to Bridge Financing REtipster

Bridge Loans in Greater Chicago and Nashville

Everything You Need to Know About Bridge Loans Avid Commercial

Bridge Loans Defined Bridge loan, The borrowers, Loan

What is a Bridge Loan? Why is it Important? Bridge loan, What is a

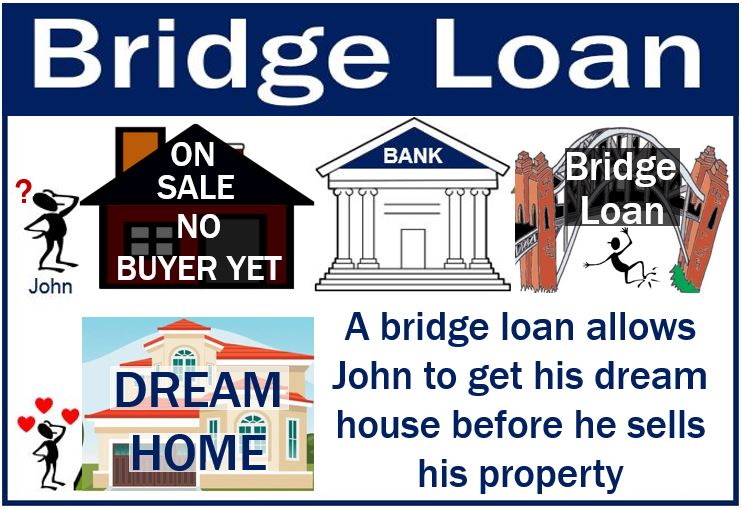

What is a bridge loan? What is it for? Market Business News

What Is A Bridge Loan? YouTube

Bridge Financing allows you to purchase and move into your dream home before your current home's closing date, bridging the gap between the two. Bridge Financing Loans are also great if you: move some furniture and clean your old house out for the new buyers before your big move. With Manulife Bank, you can carry the mortgage on both.. So, if you have made a $25,000 deposit with the offer, you will now need a downpayment of $225,000. $650,000-$400,000=$250,000-$25,000=$225,000. In addition to the downpayment needed, the bridge mortgage calculation determines how much equity you have available in your home. The APS for the sale of your home will give the lender the amount of.